Going mobile is one of the major modern trends in business, including the banking and finance industry. Today, a bank may operate without a luxurious office, but it must have an advanced website where one can access a personal account and a mobile application, so that users, regardless of their location, could perform various financial operations.

Connect with your users or clients on all platforms and devices using a custom mobile app created by SaM Solutions.

Why Should You Build a Mobile Banking App?

The main reason for developing a mobile banking app is competitiveness. An application stands out among numerous ordinary tools, as it has turned into the most convenient and effective channel of interaction with customers.

Today’s consumer would rather choose a bank with a convenient website, Internet banking, a user-friendly mobile application and speedy services; indicators such as interests and deposit rates, or the place of a bank in some ratings, are placed on the back burner. Hence, to win the loyalty of clients and remain competitive, a bank should be mobile.

In addition, App Store and Google Play have already become a giant marketing machine that can bring you thousands of clients, provided that your app is ranked among the top.

Some statistics to prove the increasing popularity of banking apps:

- Mobile banking users are expected to exceed 1.75 billion by 2019, representing 32% of the global adult population, according to Juniper research.

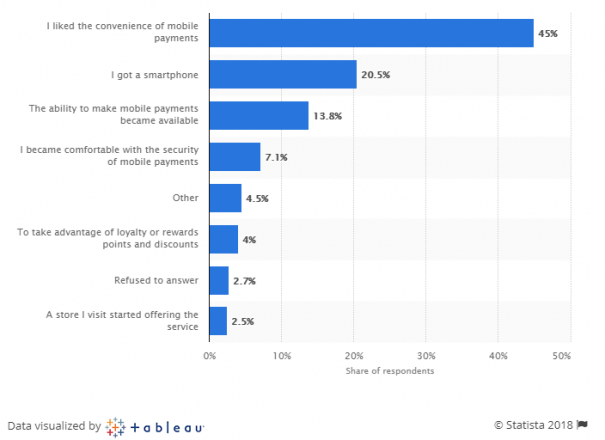

- 45% of respondents named convenience the main reason they started using mobile payments, Statista found out.

What are the main reasons you started using mobile payments?

Source: Statista

- As of June 2018, the financial business is in the top of the most popular Android app categories worldwide, taking 25.53% of the market share.

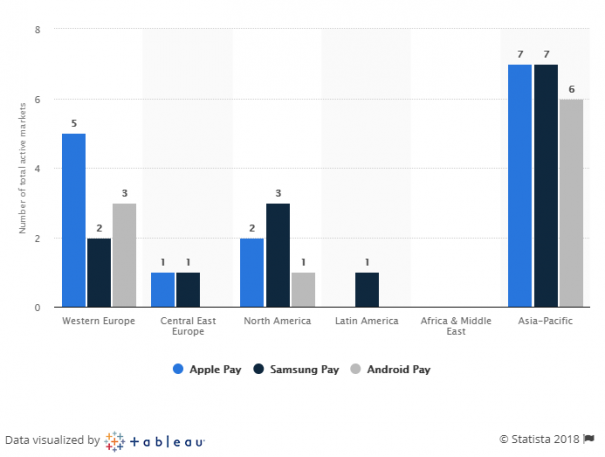

- Statista also provided data on the availability of the world’s leading payment providers Apple Pay, Samsung Pay and Android Pay in global regional markets. It turned out that the Asia-Pacific region has the highest number of total active markets across all three payment systems.

Availability of Apple Pay, Samsung Pay and Android Pay in global regional markets as of 1st quarter 2017

Source: Statista

Mobile Banking App Development: Core Features

When you create a mobile app for banking, the two most important features that should be considered are security and simplicity.

Security

In light of numerous credit card data leakages around the world, most consumers are concerned about the security risks involved with mobile payments. Therefore, responsible mobile banking app developers always make security a priority.

Here is a list of the best practices for developers and users that can reduce or completely eliminate potential safety risks.

Simplicity

The overall complexity of a mobile solution is an even stronger disincentive than data safety risks, hence, try to make it as simple as possible. The vast majority of users don’t need the complete range of banking functions in their smartphones. They just need to perform common operations in one or a couple of clicks. Instead of copying your website banking into an app, you should build its lighter version.

Develop a banking app using the following simplicity tips:

- Minimize the number of functions (an app should fulfill the primary needs of users; you may also build separate simple apps to perform different functions — this would be more rational than creating one complex application)

- Create an attractive design (properly visualized information is always appealing)

- Make an intuitive interface (the navigation should be obvious and key operations should take the least number of steps possible)

- Personalize the experience (allow users to set the types of notifications and content they want to receive)

- Customize the experience (offer shortcut buttons for the most frequent transactions)

- Control the response time (mobile is synonymous to fast; make sure that it takes your app no more than 2-3 seconds to respond; otherwise, most consumers will abandon it)

Mobile Banking App Functions

Custom mobile banking apps should offer the following basic functions to their users:

- Make bill payments (Internet, utility services, mobile communications, loans, fines, etc.)

- Make money transfers (to the accounts of the same bank, other banks or digital payment systems)

- Check the account balance and the history of transactions

Additional functions that would be an asset:

- Convert money into a different currency

- Receive a text message on every transaction and push notifications to alert of the necessity to pay for something

- Generate reports to summarize account activity

- Define geo-location of the nearest ATM or a bank office

Stages of the Mobile Banking Application Development

In this section, you will learn how much it may cost to develop a mobile banking application and what steps the process consists of.

1. Planning

This stage is about gathering ideas and clarifying project details. To create a successful product, you should start with careful planning:

- Research the target market

- Analyze competitor offerings

- Define key problems

- Generate ideas on how to solve problems

- Review best practices

- Decide on the exact features of your future app

- Choose the operating system your app will support (iOS, Android, Windows, or all of them), a programming language and development tools

On average, the planning stage lasts from two to five weeks and may cost $5,000–$25,000.

2. UI/UX Design

Designers get to work prior to developers because it’s crucial to look at the app before starting to code it. The designers’ team works in accordance with the task list created on the basis of the conducted research. They develop UI wireframing, UX design and mockups.

This stage may take two weeks and more, and the average price is about $5,000. However, the cost always depends on the number of screens in the app (each screen requires its own design), so the expenses may rise or fall.

3. Development

The next task is to vitalize the completed design. Software engineers perform two parts of the development process — frontend and backend coding.

Frontend development deals with the user interface and turns it into the functioning code.

Backend development deals with the server-side configuration, data integration and security.

Most IT companies adhere to the agile methodology of software development. The process is iterative and interconnects with continuous testing, which helps reveal and fix bugs at early stages.

The minimum duration of the development stage is five weeks for a simple app. A more complex product will require up to five months.

The cost of this stage varies greatly and may exceed $100,000. It depends on whether you create a native or a hybrid app, what platform and tools you use, and how many features you want to include.

4. Testing

We’ve already mentioned that different types of tests take place during the development process. After the product is completed, it undergoes the final testing to ensure that all the components work in harmony.

The testing stage takes up to four weeks and costs $5,000–$10,000.

5. Marketing and Deployment

At this point, your solution is released to end users. Before the official release date, active marketing and advertising should take place to attract as many users as possible and get enough feedback.

The marketing campaign can be carried out in social media, with the help of popular journalists and bloggers, via search advertising and email circulation. The cost of this stage is hard to assess. Nevertheless, marketing should be an obligatory point in your budget.

6. Maintenance and Support

Further maintenance and updating of a mobile banking app are crucial for its successful performance. This is a post-development phase and its cost is not included in the total expenses for app creation, though it should be also considered in advance.

The Total Cost of App Development

In the report by Clutch, it is mentioned that the budget for a successful complex application should range between $200,000 and $500,000. At the same time, small and simple solutions can be built for $25,000–$50,000, which is a good option for startups.

It should be also mentioned that the mobile banking app development cost greatly depends on the hourly rates of programmers in different regions of the world.

The lower price doesn’t always mean worse quality and vice versa. Don’t be scared to consider an offshore outsourcing company, as it can save you much money and develop a project at scale.

The comparison of the average cost depending on the type of an app is shown in the table below.

Examples of Custom Mobile Apps for Banks

In Google Play and App Store, you can find thousands of mobile banking solutions. Here are three illustrative examples for you to grasp an idea of what a good banking app should be.

CommBank

This is one of the many mobile apps of the Commonwealth Bank of Australia. CommBank App has the most unique range of features:

- Fingerprint or PIN to log in

- PayID, an account number or BPAY to make payments

- Cardless CashGet

- Spend Tracker and Transaction Notifications

- Tap-to-pay purchases

- Storage of loyalty cards in one place

- Ability to activate, lock, cancel or replace your card

- Ability to change credit limits and set a spending capacity

- Ability to open an account in the app

- Compatibility with Android 4.4 or above

- 100% security guarantee

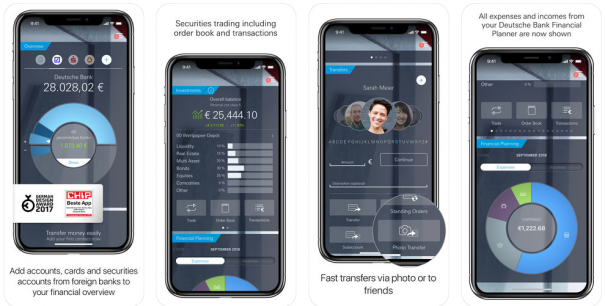

Deutsche Bank Mobile

Deutsche Bank offers its mobile banking with simple and intuitive navigation. Its core features are:

- Interactive transactions

- Finance planner

- Branch and ATM finder

- Digital postbox for bank documents

- eSafe document and password manager

- Siri transfers

- Touch ID or Face ID login

- 3D touch for quick access to key features

- Personalization of the background

- Security guarantee

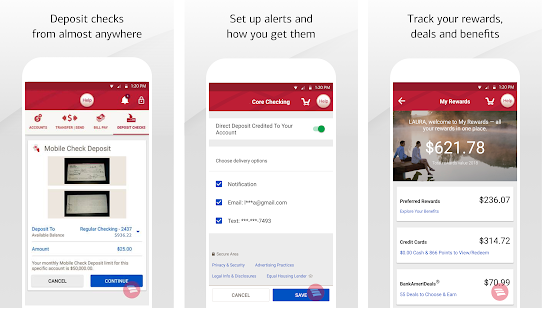

Bank of America Mobile Banking

The Bank of America offers its mobile banking app for US-based accounts. Core features:

- Control of balances and activities

- Activation or replacement of cards

- Money transfer with Zelle

- eBills payment

- Mobile check deposit

- Virtual financial assistant Erica

- ATMs and financial centers finder

- Cashback with BankAmeriDeals

- Online ID or passcode change

- Fingerprint sign-in

- Security guarantee

To Sum Up

A banking application is a powerful instrument for creating customer loyalty. You should choose the right provider to carefully plan and perform the development.

SaM Solutions has years of experience helping companies of different sizes develop mobile solutions. Our experts focus on collaboration, agility and security, resulting in successful outcomes for our clients. Fill in the contact form to get more detailed information.

5 Reasons Why Your Business Needs a Mobile eCommerce Application

5 Reasons Why Your Business Needs a Mobile eCommerce Application Using Salesforce to Improve Your Sales Pipeline: Five Tips

Using Salesforce to Improve Your Sales Pipeline: Five Tips Cross-Platform Mobile Development: Five Best Frameworks

Cross-Platform Mobile Development: Five Best Frameworks 10 Best Web Development Frameworks in 2023

10 Best Web Development Frameworks in 2023 How to Develop Custom Accounting Software

How to Develop Custom Accounting Software

Why React and Node.js Are the Top Technologies for Creating High-Performance Web Apps in 2024

Why React and Node.js Are the Top Technologies for Creating High-Performance Web Apps in 2024 10 Best IoT Platforms for 2024

10 Best IoT Platforms for 2024 Top 20 Latest Trends in the Ecommerce Industry in 2024

Top 20 Latest Trends in the Ecommerce Industry in 2024 Top 10 Most Popular Programming Languages in 2024

Top 10 Most Popular Programming Languages in 2024 Digital Transformation Strategy [+ Key Trends in 2024]

Digital Transformation Strategy [+ Key Trends in 2024]

Hey there! I simply want to give you a huge thumbs up for your great information you’ve got here on this post.

I am returning to your site for more soon.

You’ve compiled interesting information on the topic, nice to read the article. It’s a pity that not all banking applications are intuitive and simple to use. Security may also be an issue.

Mobile banking is an obligatory service any finance organization should deliver to its clients. Today, it is for the sake of competitiveness, because people want to fully control their banking accounts; and if they don’t have such an opportunity, they will turn to another company.

I think this is one of the most vital info for me.

And i am glad reading your article. But want to remark on few general things, The website style is wonderful, the articles is really great.

Good job, cheers

Not all mobile banking apps are user-friendly, it is irritating. Developers should read guides like this one and apply tips in practice, then all applications would be great.

Nicely written and done my friend.

I started blogging myself recently and realised that lot of articles merely rework old ideas but add very little of worth. It’s fantastic to read a useful write-up of some actual value too your readers and me.

Some awesome ideas; you’ve certainly got on my list of writers to follow!

Continue the terrific work!

If a bank wants to attract more loyal clients, it must develop a high-quality mobile banking application. This guide provides sound tips on how to create a good banking app.

Mobile applications penetrate every sphere of our life. It’s very convenient to use mobile banking apps, you can perform transactions anytime and from any location, providing that the app is reliable and well-designed.

Very intresting information which motivating every app developer to develop a good banking app from scratch. Superb information.