Many industries start adopting IoT technologies to stand out in an oversaturated market, as the potential of connected products is immense. The insurance industry is the one that can experience the Internet of Things value most of all. Read this article to learn how IoT impacts insurance and what opportunities it provides.

The Internet of Things (IoT) is a network of sensors, devices, tools, services, people, and organizations that are able to connect, exchange information and communicate with each other. Only a few years ago, this fast-growing force was just a futuristic buzzword. Today, the IoT is the reality that has already transformed many industrial sectors, providing them with diverse data. Using this data, companies offer new services, build new applications and improve their efficiency.

With SaM Solutions’ wide range of IoT services, you get professional support and hands-on assistance at any stage of your IoT project.

The insurance business is based on the ability to assess risk. Historically, agents had to rely on past experience, analytics and the information provided by the applicants, with the latter being potentially subjective. With the implementation of connected devices into the underwriting process, insurers get access to a wide range of personal data and can create a more precise picture of a client.

Keep reading to find out how the Internet of Things is changing insurance.

The Impact of IoT on Insurance

Why does the IoT matter in insurance? Because this business is predicated on data, and IoT provides volumes of data. Consequently, carriers get deep real-time insights into policyholder behavior and gain the following advantages:

- Assess risks more precisely

- Improve loss controls

- Cut cost

- Better manage price policy

- Accelerate growth

- Improve business practices

There are also benefits for clients:

- Discounts and personal offerings

- Simplified contract process

- Elimination of lengthy checks

- Management of personal risks during a policy year

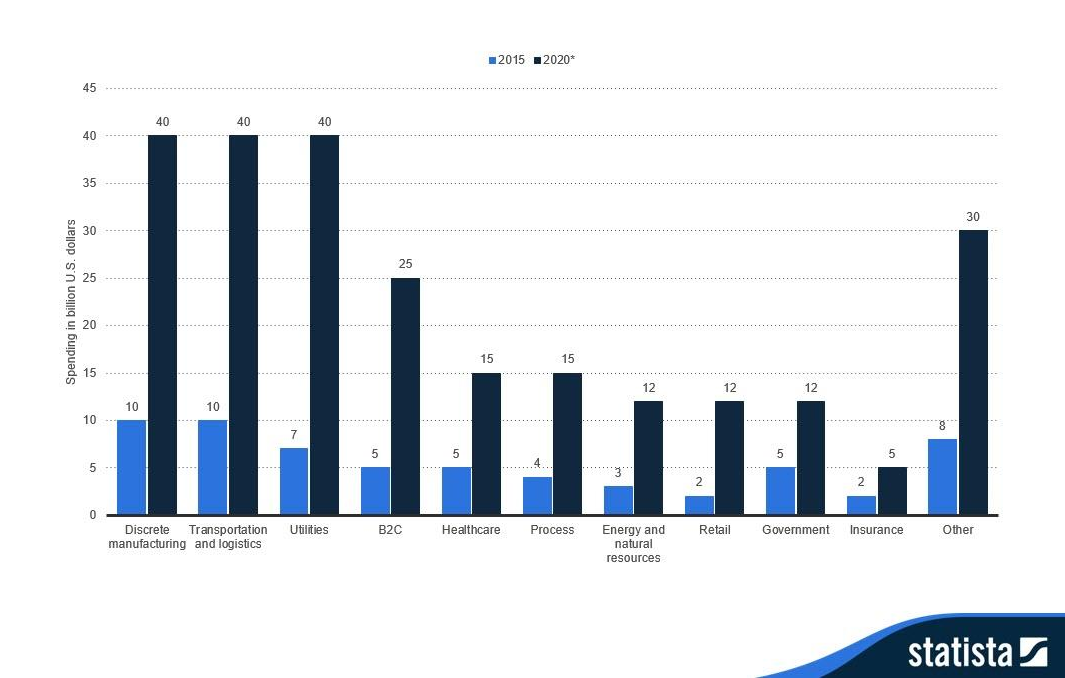

In the next few years, insurance companies are predicted to increasingly invest in the Internet of Things. The impact of IoT in the insurance industry is going to be remarkable. According to Statista, the insurance industry will increase its IoT expenses from $2 billion in 2015 to $5 billion in 2020.

Spending on IoT worldwide by vertical, in 2015 and 2020

Source: Statista

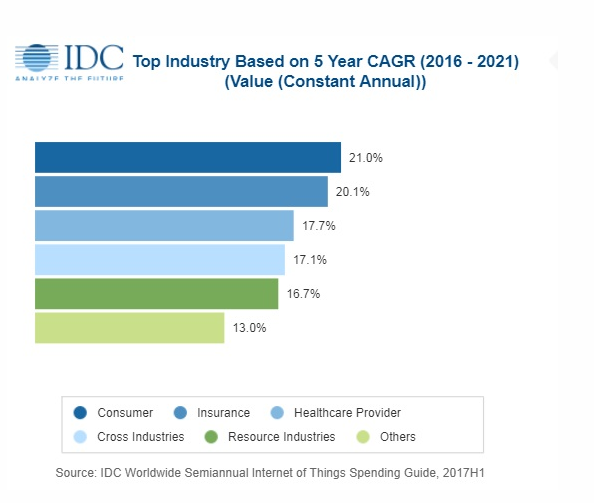

IDC forecasts that the consumer industry will experience strong spending growth over the next five-year period, and will be the fastest-growing industry segment with an overall CAGR (compound annual growth rate) of 21.0%. The Internet of Things insurance claims to take second place with a CAGR of 20,1%.

Top Industry Based on 5 Year CAGR (2016-2021)

Source: IDC

The IoT Use Cases in Insurance

Insurers use a few types of data sources for practical IoT applications.

Sensors on Vehicles and Machines

These sensors are the followers of traditional telematics and fleet management. They gather metrics such as distance traveled, speed and frequency of braking. Diagnostic sensors are set up on industrial equipment to alert users if there is a malfunction or a breakdown risk.

Environmental Sensors

These are set up in houses, offices, factories and other buildings to detect temperature, humidity, toxic fumes, mold, smoke or other hazardous conditions. Such sensors can also be installed in drones and cameras to control environmental conditions and provide useful data for various industries, e.g. agriculture.

Biometric Sensors

Also known as wearables and fit tech, these sensors are used to monitor health, body condition and behavioral habits. Connected health devices extract metrics such as heart rate, pulse, blood pressure, number of steps taken, and more.

In industrial settings, the sensors might send an alert when workers exceed permissible workload, violate safety regulations, abuse substances or may be injured because of the fatigue. Numerous employers have established programs that award points to employees who are adhering to a healthy lifestyle. In all cases, the employer, the employee and the insurance carrier all benefit from an improved understanding of risk and more accurate pricing. For instance, biometrics may help predict impending heart attack and trigger a proactive alert or preventative actions.

Geographic Information Systems (GIS)

These sensors provide geophysical, topographical, climatological and hydrological data. They can help insurers better assess risk related to weather and seasonal variations for industries such as agriculture, aircraft, shipping, sports, etc.

In the current market, three main segments that are actively integrating IoT devices can be distinguished:

- Connected car insurance

- Connected health insurance

- Connected home insurance

Agents from these segments already offer usage-based insurance (UBI) to their clients. How does this new model work? Clients are offered intelligent devices to track their personal activities and conditions of their property. In the case of safe behavior and conditions, clients get discounts or rewards.

Examples:

- Auto insurers — the leading adopters of UBI models — use smart solutions that gather metrics from the vehicles of policy owners, e.g. data about speed, distance, turning and braking patterns, time of day and more. Gathered data helps correctly price and manage UBI. Responsible drivers get the lowest insurance premium. For the carrier, this means a premium increase, reduced loss ratios and improved margins.

- In the Internet of Things health insurance segment, customers are given free fitness trackers to control their activities. In case they meet certain goals, they get lower premiums or other benefits. Therefore, wearables and other health technologies provide carriers with valuable data that can be used to adjust rates more fairly and profitably, and help customers prevent injuries and diseases.

- Home and property insurance companies are inducing customers to install connected devices that warn of potential danger (fire, flood, robbery). They also use drones to assess damages after an incident has occurred.

As we see, the IoT technology transforms the industry creating a new business model — Connected Insurance. This facilitates the direct connection between all actors of the insurance ecosystem across various industries.

In 2019, two big events will address this topic:

Connected Insurance Summit Europe, May 15-16, 2019, Amsterdam, the Netherlands

Connected Insurance Summit USA, November 20-21, 2019, Chicago, USA

Challenges Within Connected Insurance

Every significant change is always challenging. Combining insurance and IoT is not as easy as it may seem: the process requires heavy investment and new talent, together with a complete transformation of the corporate culture.

The main predicted challenges are:

- Data storage and processing. IDC reports that there will be 50 trillion gigabytes of data produced by the IoT in 2020. It will be extremely difficult for carriers to store and process this data and turn it into useful insights.

- Compatibility with existing models. Current management strategies are not suitable for the new type of information gathered by connected devices. Thus, the Internet of Things commercial insurance companies should develop new strategies to incorporate new technology.

- Data privacy and ownership. The big question about who owns the data — the company or the customer — still remains open.

- Trust of consumers. It will take time for people to start trusting the new technology and adapting it without fear of repercussions.

- Security. This is the biggest issue of the whole IoT industry.

- The relevance of the insurance industry. Some experts anticipate that IoT technologies may replace insurers and generally eliminate the need for their services. For example, if a house is monitored 24/7 for break-ins, and the chance of a fire or flood decreases incrementally because the appliances, water and heat systems are under constant control, a customer may not want to pay extra money for insurance.

IoT Is Coming

In spite of all the challenges, sooner or later we’ll have to face a fully connected future. The Internet of Things will definitely change the insurance industry, turning it from a reactive claims payer to a preventive risk adviser. Other segments of the global market will be affected as well.

SaM Solutions has vast experience in implementing IoT projects. Our professionals can help you with solutions concerning the Internet of Things in the insurance industry and other commercial solutions of any complexity. Learn more from our specialists and leverage IoT insurance industry opportunities with SaM Solutions.

5 Reasons Why Your Business Needs a Mobile eCommerce Application

5 Reasons Why Your Business Needs a Mobile eCommerce Application Using Salesforce to Improve Your Sales Pipeline: Five Tips

Using Salesforce to Improve Your Sales Pipeline: Five Tips Cross-Platform Mobile Development: Five Best Frameworks

Cross-Platform Mobile Development: Five Best Frameworks 10 Best Web Development Frameworks in 2023

10 Best Web Development Frameworks in 2023 How to Develop Custom Accounting Software

How to Develop Custom Accounting Software

Why React and Node.js Are the Top Technologies for Creating High-Performance Web Apps in 2024

Why React and Node.js Are the Top Technologies for Creating High-Performance Web Apps in 2024 10 Best IoT Platforms for 2024

10 Best IoT Platforms for 2024 Top 20 Latest Trends in the Ecommerce Industry in 2024

Top 20 Latest Trends in the Ecommerce Industry in 2024 Top 10 Most Popular Programming Languages in 2024

Top 10 Most Popular Programming Languages in 2024 Digital Transformation Strategy [+ Key Trends in 2024]

Digital Transformation Strategy [+ Key Trends in 2024]